does indiana have a inheritance tax

Indiana repealed the inheritance tax in 2013. Instead some Indiana residents may have to pay federal estate taxes.

Should Indiana Phase Out Inheritance Tax Indianapolis Business Journal

How much tax will you pay in indiana on 60000.

. In 2021 the credit will be 90 and the tax phases out completely after December 31 2021. If you have received an inheritance or know you will be receiving one and live in one. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation.

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12. Get Help For Your Inheritance Tax. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year.

Indiana has no state taxes on inheritance or estates of residents and non-residents with property in the area. You only have to pay us inheritance tax if the deceased was a us resident citizen or green card. Inheritance tax was repealed for individuals dying after December 31 2012.

Does Indiana have inheritance tax 2021. At this point there are only six states that impose state-level inheritance taxes. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566.

For deaths occurring in 2013. Here in Indiana we did have an inheritance. Indiana used to impose an inheritance tax.

No inheritance tax has to be paid for individuals dying after December 31 2012. The Inheritance tax was repealed. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for.

Final individual federal and state income. An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. This tax ended on December 31 2012.

Indiana does not have its own inheritance or estate taxes. How Much Tax Will You Pay in Indiana On 60000. In 2021 the credit will be.

On the federal level there is no inheritance tax. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary. However individuals must file.

Indiana has a three class inheritance tax system and the exemptions and tax rates.

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

State By State Estate And Inheritance Tax Rates Everplans

What Should I Do With My Inheritance Inside Indiana Business

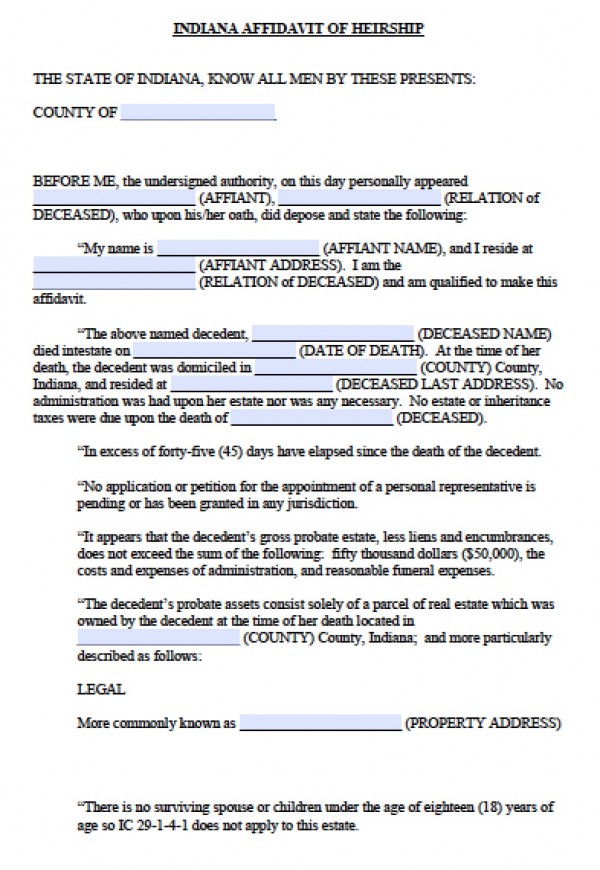

Free Indiana Affidavit Of Heirship Form Pdf Word

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

How Indiana Probate Law Works Probate Advance

Estate Planning Facts An Overview Of Indiana Inheritance Laws

Indiana Department Of Revenue Inheritance Tax Section Indianapolis Bar Association Estate Planning And Administration Section March 28 2012 Don Hopper Ppt Download

Welcome To The State Death Tax Manager Leimberg Leclair Lackner Inc

Indiana Inheritance Tax Is Your Inheritance At Risk Indianapolis Estate Planning Attorneys

Indiana Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Affidavit Of Transferee Of Trust Property That No Indiana Inheritance Or Estate Tax Is Due On

Form Ih 6 Indiana Inheritance Tax Return Note Local Courts May Require This Form To Be On Green Paper

State Estate And Inheritance Taxes

State Estate And Inheritance Taxes Itep

Will My Heirs Be Forced To Pay An Inheritance Tax In California